What Is Modern Financial Education?

The average investor is unskilled. Because of this, financial education should be our first priority.

SUMMARY

The advice on traditional finance is now antiquated and ineffective.

The majority of individuals lack fundamental financial knowledge, and they are unaware of their deficiency.

The key to controlling, liberating, and accumulating real riches is financial knowledge.

To become great at business and investing we must adopt several must-know lessons for mastering money and building wealth.

At the end of today’s discussion we will cover our bonus question“What Are The Essential Points For A Business Plan?” Investing is define in our community as having a winning business plan with lucrative exit strategy.

The tax legislation acts like a stimulus plan

MASTERINVESTOR® created the Cash-Flow-Circle and how it divides income producers into various four types of people and two sides the left side and right side. We periodically examined the sides of the Cash-Flow-Circle to see how tax law relates to the diagram.

When he realized that the government wants people on the right side of the cash-flow circle—the Business Owner & Inside Investor side (right side of the cash-flow-circle)—to pay less taxes, it was an eye-opener.

There was a time when the financial world was simple. If we followed the old counsel of "go to a good school, get a good job, buy a home, save money, and invest in a diverse portfolio of stocks, bonds, and mutual funds," we would be alright for the most part. Sounds great.

But eventually, the monetary world grew more and more complex. The value of the dollar fluctuated wildly as a result of its removal from the gold standard. Employers in employer-funded defined benefit programs began to switch to defined contribution plans, which require employees who lack financial literacy to invest in the stock markets.

This led to the rise of the financial advisor profession. Additionally, the world of finance grew more and more interconnected, making it harder to monitor the markets. The outcome is a baby boomer generation that is unprepared for retirement and a coming financial disaster.

The baby boomer generation failed to learn from its errors and prioritize financial literacy for its children, the millennials, despite all expectations.

Nearly 80 percent of millennials are not invested in the stock market according to a case study.

When asked why:

40% of respondents said they didn't have enough money.

According to 34% of respondents, they are unsure of how to do it.

Student debt was cited as the cause by 13%.

All of these are the symptoms and justifications of those who are financially illiterate.

Old money advice states that if we don't have enough money, it's because we have never learned how to earn it outside of landing a decent job.

Majority of people today have probably received old financial advice telling them to save and buy a house, which is why most weren't taught how to invest. The good news is that high quality financial education is here.

We believed the old money fallacy that attending a good school was necessary for success, and as a result, we have so much student debt that we cannot afford to invest.

Financial literacy fundamentals: a novel characteristic

A couple of years ago, the U.S. Securities and Exchange Commission published a special report with the conclusion that "U.S. retail investors lack basic financial literacy (and) have a weak grasp of elementary financial concepts."

They used a variety of sources for their study, including one that came straight from the Financial Industry Regulatory Authority (FINRA), which is the regulatory body and watchdog for brokerage businesses.

The financial quiz they use includes a straightforward query that FINRA posed to the general public: "If interest rates rise, what will usually happen to bond prices? Will they rise, fall, remain the same, or is there no relationship?" Sadly, only 28% of the respondents accurately predicted that bond values would decline.

Consider this: Only somewhat over a quarter of the millions of individuals with money invested in mutual funds, bond funds (many of which own bonds), and 401(k) plans understand how interest rates impact bond values, as shown by this one simple question.

This is only one fundamental question, but it's indicative of the larger issue facing novice investors. Since our system lacks financial education, it is our responsibility to acquire it on our own.

How big is the issue? The report continues by stating that, of the teachers responsible for instructing financial subjects in our schools, less than 20% felt very competent in this capacity. Because not even the instructors are able to adequately support young people in developing this aptitude and understanding, financial illiteracy is perpetuated throughout our culture in this manner.

They enjoy keeping us in the dark

But be sure that a lot of financial counselors would rather we stay uninformed about making our own investments. Wall Street makes a lot of money by managing our investments for us.

One of the strategies they employ is to persuade us that we lack the intelligence to manage our own investments. Many of these professionals prosper by preserving our ignorance. Financial planners, stockbrokers, and other advisors will have a lot of job security as long as individuals continue to cede authority over their financial future to others.

It simply takes a unique type of advisor because providing the assistance we deserve requires a lot more effort on their part, even though there are excellent advisors out there who are willing to collaborate with hands-on investors.

However, it is far simpler—and frequently safer from a professional standpoint—for financial counselors to advise clients to follow the standard strategies of their firm rather than develop a plan that aligns with the client's objectives.

Retirement plans like 401(k)s don't involve any personal planning. It's common in our plan that we only have a few pre-made funds to select from. Investing in that manner doesn't increase your knowledge. Additionally, it doesn't need any knowledge from our 401(k) provider.

People will probably never ask for anything more than what they have if they continue to be ignorant of how to manage their own finances. We have learned to put up with anything that these businesses provide. The more they can keep us ignorant, the more money they will make. If we work in the mutual fund or 401(k) sector, it's the ideal business plan.

Since these funds are usually linked to the whole stock market—or a particular segment of it—very little skill is required to handle them. This implies that they are placing our future in the hands of the market's fortune, with little additional management to safeguard our investment.

Being ignorant puts us in grave danger

Consider this notion: We may be harmed by what we are ignorant of, and it's likely that at some point in the future, we will be.

This is particularly true with investments. People with the greatest knowledge will make the most money. The folks who are less informed will lose the most.

We are compelled to rely on others when we are unable to accomplish anything for ourselves. Additionally, we are giving up control over our lives when we depend on others. Many individuals have grown completely reliant on outside counselors, such as their 401(k) providers, to manage their finances due to a lack of knowledge. These mysterious counselors hold the key to fulfilling their aspirations.

It could be that we have been led to believe in these anonymous financial advisors because of a fictitious illusion. It is believed that they have nearly supernatural predictive skills that are far beyond our own, even to the point of, it is said, being able to foresee the future. Furthermore, we are led to believe that ordinary people like you and me are incapable of possessing these extraordinary talents.

Our culture has reached the conclusion that we are unable to acquire these talents on our own, that we are unable to perform the "magic" that they do. As a result, we are at the complete mercy of the 401(k) firms as we silently kneel before them and lay our futures on their altars.

Apathy, not ignorance, is our worst foe

Not giving any care about what's going on with one's account could be even worse for investors. Rather than think about the alternative, isn't it much simpler to just collect the mail, pull out yet another quarterly statement, shake our head at the dismal results, and take no action?

Since it might feel overwhelming and challenging to ask difficult questions and take action. It's easy to be apathetic, but in the end, it may cost us a fortune.

Is it due to our laziness? Perhaps we imagine that a hero will come riding in on a white horse at the last second and increase the numbers on that quarterly report by a few zeros? In this tale, we are the only savior. We are the only one with the motives and reasons to alter the way the tale concludes.

We may direct ourselves toward the future we genuinely want if we are able to overcome the apathy that is preventing us from actively managing our own finances.

Don't only invest; be an inside investor

This means getting financial education and applying it actively with a business plan that has an exit strategy. New investors often make the mistake of concentrating on the investments they want to own rather than the person they wish to be. Anyone may own investments, regardless of their level of knowledge or comprehension. However, in order to genuinely control our financial future, we must acquire the mindset of an investor that will enable us to attain the outcomes we want.

We will like gaining a greater understanding of the strategies people use in the stock market to generate monthly cash flow and retire early as we focus on increasing our investment knowledge through education. We will eventually come to see not just that it's doable, but also that we can develop the skills necessary to make wise investments that will help us succeed.

The ultimate goal is proficiency—the capacity to make the correct decisions that will produce the desired outcomes. Those who are proficient have become investors, whereas those who lack proficiency just own investments and are reliant on others.

It's never too late

As a millennial who has been living by the outdated financial advice they were raised with, here are a few things we may do to improve our financial future.

Invest in learning about finances

Assume control of our financial destiny. Don't count on anyone else doing it for us, and don't expect it. Go through our schedule and ruthlessly eliminate anything that takes up our time but does not add much value. After that, complete a course of financial education that has been prescribed. Get a mentor, read blogs and books, listen to podcasts, go to workshops, and network.

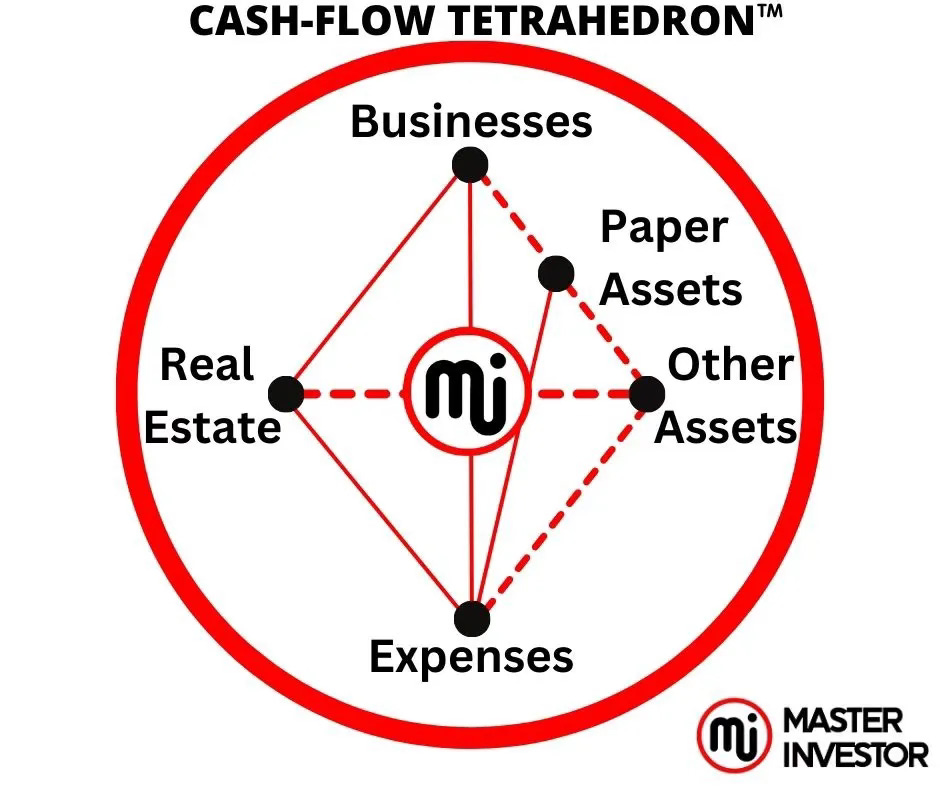

Quit saving for retirement

Furthermore, begin saving for investments. Don't simply sit on your savings now that we have acquired new financial skills. Invest it. And don't assume that this applies only to the stock market. Consider all four asset classes: paper, commodities, real estate, and business. Learn, start little, and grow from there. Treat it like a video game in real life.

Learn to put off getting satisfaction

It will be tempting to "treat ourselves" once we begin to experience some investment success. Do not. At least, not right now. Instead, put our money to good use by investing it. After we have learned how to invest, use our cash flow to pay for our liabilities, such as holidays, cars, and other items. However, only after our income from investments has taken the place of our wage. Hold off on gratification until then.

Our financial situation will shift if we do these three things. And we will be miles ahead.

Turn investing into a necessary life skill

We have the potential to be more than just a worker bee in life. Our brains are fantastic at picking up new knowledge and developing new abilities. We may have a wide range of skills, both male and female. We can pick up knowledge that will be helpful to us. When we decide that it's crucial to us, we may cultivate untapped abilities.

If making money via investments is important to us, we can learn new skills that will give us freedom, time, and tremendous pleasure in our lives.

Just as individuals enroll in courses to learn how to play an instrument, cook a gourmet dinner, or ride a motorcycle safely, we may devote some time to learning new things after completing our official 'education' at high school and university.

People are, however, less inclined to seek solutions if they are unaware that a problem exists. If our goal is to be financially independent, start by putting these ideas into practice. Our life may be transformed by these skills.

The 17 must-know lessons for mastering money and building wealth

What does it mean to be financially educated? That's a great question, and the answer varies widely depending on who we ask.

Teaching children how to save money, manage a checkbook, and use credit cards responsibly is one definition of financial literacy.

For some, it involves instructing them on how to manage a 401(k) and invest in the stock market.

No matter how you define financial education, one thing is certain: our schools lack it almost entirely.

Today we must obtain modern or high-quality financial education to be able to succeed. The new rules of money are here and the old ones do not longer work to win

About half of American adults are financially illiterate, according to the World Economic Forum. Furthermore, over half of Americans refrain from investing since they are uncomfortable with their degree of understanding.

This raises the issue of what teaching financial education in our schools would look like.

Masterinvestor’s complete guide to financial education

The following 17 fundamental financial education courses are necessary for accumulating wealth. These are important lessons to learn and study independently as part of our financial education, even if we are no longer in school. Financial education must be something we continue to seek through our journey.

Lesson 1: Money's History

Understanding how money functions is crucial, and a portion of that involves researching its historical usage. Over the centuries, money has evolved from something relatively straightforward, like bartering, to something quite complex, like derivatives. It is no longer concrete and intuitive because it has transformed from an object to an concept. To accumulate wealth, it's critical to understand money.

The following are some significant dates:

1903 - The U.S. educational system is taken over by Rockefeller's General Education Board.

The Federal Reserve is established in 1913.

1929: The Great Depression.

The Bretton Woods accord of 1944

Nixon removes the dollar from the gold standard in 1971.

Congress enacted the Employee Retirement Income Security Act in 1974.

Read our article on fake money if we want to discover more about how our life is being influenced by the history of money.

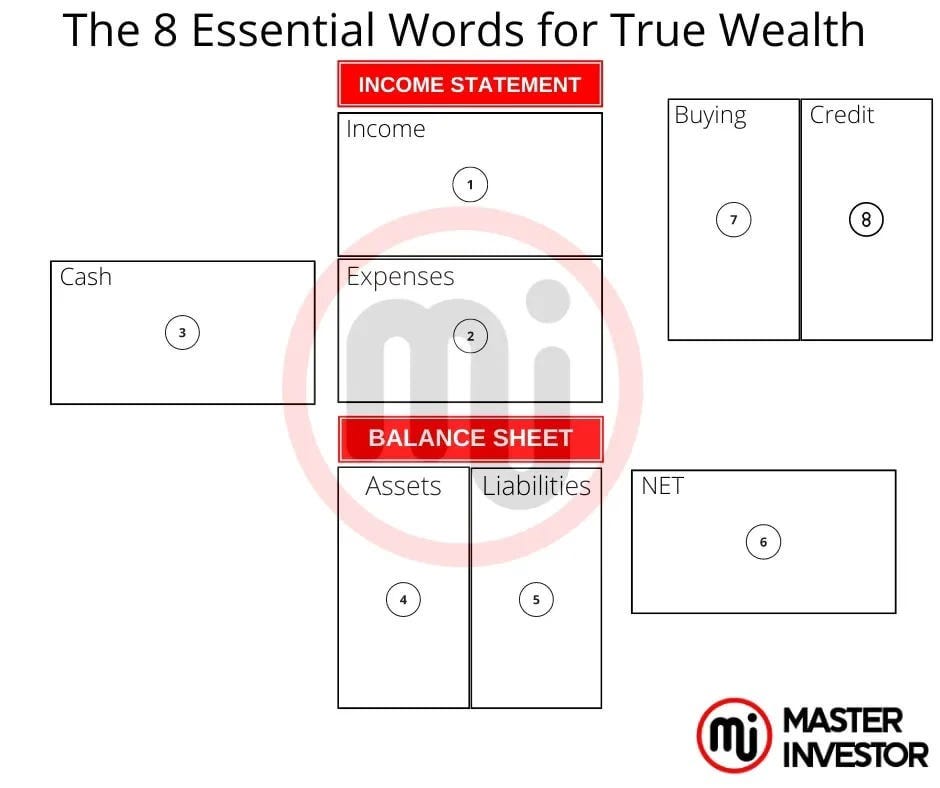

Lesson 2: Knowing Our Personal Financial Statement

Our banker never requests to see our report card. A banker wants to see our financial statement, which is similar to our report card from school.

Knowing how to read and comprehend a personal financial statement is one of the cornerstones of financial literacy.

Get our digital course to find out more about the personal financial statement and how to start using one right now.

One important conclusion is that it's more about how much we keep (expenses) than how much we earn (income).

One of the main differences between the poor and wealthy is our financial education. People that lack wealth and wealthy context simply lacks financial education.

Lesson 3: Understand the distinction between assets and liabilities

One reason that so many individuals experience financial difficulties is because they conflate assets and liabilities. For example, many individuals consider their home to be an asset when, in fact, it is a liability. A basic difference between the two is that a liability is something that takes money out of our pocket, while an asset is anything that earns us money.

We have probably believed throughout our life that generating money requires concentrating on our earned income. We will discover that the secret to achieving financial freedom is to concentrate on our assets’ column.

Learn how to turn our debts into assets.

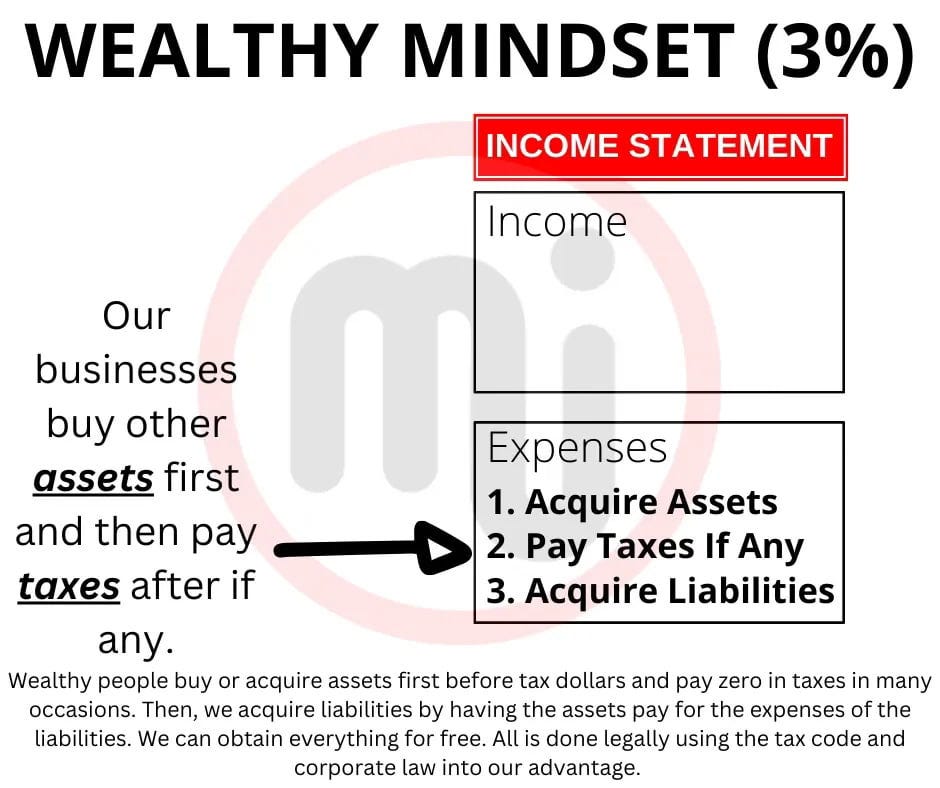

Lesson 4: Prioritize Positive Cash Flow Before Capital Gains Income

Many individuals invest for capital gains, which means they are wagering that the price of an asset will increase. Regrettably, this is a bet that isn't always successful. Rich people invest for cash flow rather than capital gains, which are optional and can occur.

The primary distinction? Real estate will serve as an example. Investing for cash flow involves purchasing a property and renting it out to generate monthly cash flow, which turns it into an asset. When we purchase a property with the intention of selling it after the price has increased, this is known as investing for capital gains. While this strategy can be effective at times, the property is considered a liability rather than an asset since it is not generating any cash while it is waiting to be sold. Rather, it's costing us money.

Learn more about the distinctions between capital gains and cash flow here.

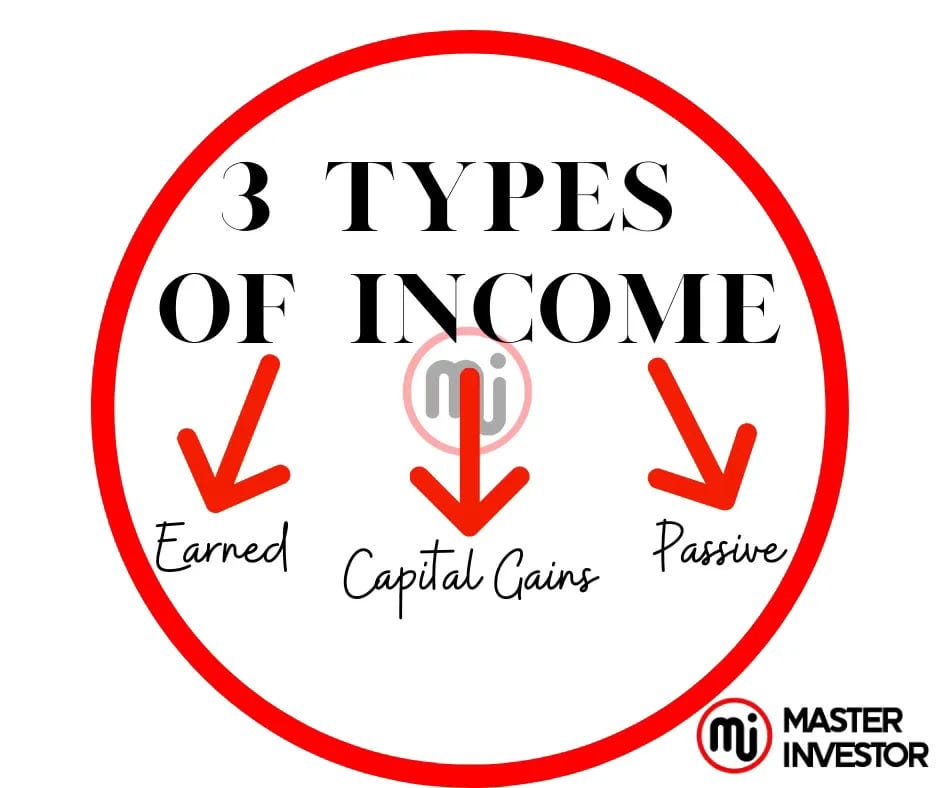

Lesson 5: Three Income Types

Not everyone makes money via paychecks. In fact, masterinvestor teaches that there are three different kinds of income: earned income, capital gains income, and passive income.

We earn money through earned income if we have a job and get a paycheck. We earn money through capital gains income if we profit from the sale of assets. Passive income, the third kind, is income earned without the need to work via a business or investment which is compose of a system of systems.

The true meaning of wealth is generating money through passive income.

Learn more about the various income categories here.

Lesson 6: The CASHFLOW Circle

Masterinvestor claims that there are two kinds of people, and that they see the world through the two distinct sides of the CASHFLOW Circle.

In conclusion, Employees and Self-employed people are on the left side of the quadrant. They exchange their time for money and pay the highest taxes. Moreover, each one has a unique way of thinking.

The Business owners and Investors, however, are on the right side. They pay significantly lower taxes, but they create or invest in assets that generate income for them even while they sleep.

Explore the CASHFLOW Circle in greater detail.

Lesson 7: Savers Are Losers and Good Debtors Are Winners

President Nixon altered the monetary rules in 1971. He closed the gold window that year, converting our gold-backed dollar into a currency overnight. Despite being one of the most significant monetary changes in recent history, few individuals understand the reasons behind it.

This shift is what caused savers to lose out. Inflation is causing the dollar to continue to lose value. In essence, our money will be able to buy less in the future than it does now.

So keep this in mind: money flows like a current. It will die if it doesn't move. As a result, savers suffer.

Click here if we want to learn more about why saving is for losers.

Lesson 8: Our Net Worth

Our bank account balance or net worth do not reflect true wealth. Our wealth number determines our true wealth.

In summary, we have an unlimited wealth score if we earn more money from passive income than we spend each month.

The question "If we (or we and our partner/spouse) stopped working today, how long could you survive financially?" has two crucial components for determining our Wealth Number.

If we quit working now.

This implies that we will no longer receive any earned income. For any reason, we are no longer able to work for a company or employer, thus we are not earning any money from those sources.

How long could we last money-wise?

Determine our net worth. Financial education must be acquire to really understand how to be wealth.

Lesson 9: Fundamental vs. Technical Investing

Understanding a financial statement is the first step in assessing a company's financial performance, which is what fundamental investing is all about. Technical investing involves gauging the markets' emotions or moods through the use of technical indicators. Both kinds of investing may lead to success, but they both need dedication and ongoing financial learning.

Discover the distinctions between fundamental and technical investing here.

Lesson 10: Understand how to evaluate an asset's value

The five asset categories are cryptocurrency, commodities, paper assets, real estate, and business. To get wealthy, we must learn about these categories, select which one is best for us, and strive to become an authority.

The realm of investing is replete with possibilities. This raises the question of which investments are worth chasing. A fundamental aspect of comprehensive financial education is learning how to assess whether an asset is of high quality. One of the most effective methods to accomplish this is to consult the Cash-Flow Triangle or Business Owner and Inside Investor Triangle, which considers all of an asset's attributes, including its team, leadership, mission, cash flow, communication, systems, legal framework, and product.

Lesson 11: Know How to Select Good People

Partnerships are essential for business success. The best way to know a good partner is to have had a bad partner. If we have a terrible partner, a lot may explode. This means that selecting team members and partners carefully is essential

We must gain knowledge from each encounter. That's how we become a successful leader on our journey to financial independence.

Lesson 12: Understand When to Diversify and When to Concentrate

We should aim to be diversified across all five asset types, but we should concentrate on mastering one at a time. An old saying goes, "If we try to please everyone, we will please no one." The same might be true of investing.

Lesson 13: Reduce the Risks of Our Investments

There is always a degree of danger involved in commerce and investment. A wise investor understands how to reduce risk through hedging, and there are several methods to achieve this within each asset type. Educate ourselves on strategies to reduce risk in our selected asset class.

Investing can be dangerous for three main reasons:

Insufficient training

Loss of control

Inadequate knowledge

To reduce the dangers related to investing and commercial activities, consider the following advice.

Lesson 14: Increase Our Income Through Taxes

It's not about how much we make, it's about how much we keep and keep working hard in sound investing, as we stated earlier. Our greatest cost is taxes. For this reason, it's crucial for our financial literacy to comprehend how to most effectively reduce that cost.

A financially savvy individual knows how to exploit the tax code to their benefit.

To find out more about tax savings, click here.

Lesson 15: Master The Two Types of Debt: Good Debt and Bad Debt

As most of us are aware, debt may be categorized as either positive or negative. We will quickly lose credibility if we don't have a concrete strategy for repaying our debt.

The secret to leveraging debt is understanding how to take out loans responsibly and how to repay them. The wealthy invest in cash-generating assets using Other People's Money (OPM), which includes the money of investors and banks, and use good debt to increase their wealth.

A comprehensive financial education will cover these various forms of debt as well as how to repay them.

To build wealth we must master good debt and bad debt. The wealthier we will become the more debt we shall have. Whether is good or bad, we know how to manage debt. It is key to first focus on using good debt to create passive income then use that income to acquire other sound assets and whoever liability we want to have in our lives.

At the end of the dat, we can reach an Infinite Return On Investments when we use debt to invest in sound assets. The more debt we use, the less taxes we will have to pay. The more money we get to keep to continue to invest it in sound investments.

People who lack modern financial education preaches get out debt to build wealth and encourage others to not use debt. In our community at masterinvestor, we encourage our member to use debt as much as possible and create passive income with it. Our partners here at masterinvestor know that debt is valuable to building wealth and debt is today’s money.

Debt provides us with many advantages such tax advantages and leverage. We can get wealthy for free legally and obtain anything we want for free by positioning a business to solve a problem. Once we begin to receive the passive income (positive cash-flow) from the business then that money will be use to buy what we want. As an inside investor we must invest in financial education and actively invest in all the asset’s classes that exist today.

Lesson 16: Understand How Our Money Is Stolen

Taxes, debt, inflation, and retirement are the four factors that deplete our wealth. A good financial education will emphasize learning how to profit from these wealth-stealing factors rather than losing money.

Here's how to stop these con artists from taking our money. Invest in the proper financial education to ensure we know how to invest in sounds assets and avoid toxic investments.

Lesson 17: Understand how to err

Learning is impossible without encountering some errors along the way. The important thing is to not let those errors drive us off the game and to take their lessons. View failure as a chance to learn.

No matter which route we choose. The most crucial thing is to get started.

Getting Started

Many of the truths we cherish at masterinvestor are covered, and they provide numerous ways to enhance our financial knowledge.

Here are some free choices:

Listen to our podcasts on the go.

Check out more articles on our blog about financial education.

Take part in one of our financial literacy courses.

Are we prepared to start accumulating wealth today?

Bonus Question: What Are The Essential Points For A Business Plan?

The secret to building a successful company is to write a good business plan. A business plan is essential, regardless of whether we need outside funding. Our business plan will be successful if it includes these essential elements.

The need for a business plan is up for question among professionals. Some claim that a business plan is only necessary if we are asking investors for financial assistance or a loan. Some have even argued that the time it takes to develop a business plan might hinder the launch process and result in lost opportunities for a small company.

Here at Master Investor, we believe that a company plan is crucial for success. Writing a business plan is essential, regardless of whether we need outside investors or not. The process of creating a successful strategy necessitates that we devote a lot of time and effort to researching and considering our business.

It's important to remember that "strategic planning" also involves writing plans to help established companies expand, although that topic will be covered elsewhere. The goal today is to establish a structure that will persuade us, and an investor, that our plan includes the elements necessary to be one of the 5% of new firms that succeed. Unless we educate ourselves on the realities of winning plans, our plan will probably end up in the trash bin because wise investors and lenders are aware of the odds.

Having the right financial education is the way to stay ahed and not be an average investor.

The benefits of writing a business plan

Before we have even entered the trenches, we are essentially laying the foundation for how our company will run by taking the time to write a business plan. Our business plan will help us with our startup, daily operations, allocation of resources for the company, specifics and boundaries of our partnership with our business partner, and a clear view of our organization, allowing us to make educated decisions about the cost of our services and products.

We want to focus mainly on building and acquiring product based businesses instead of services. Simply put that when we have products then we can sell to the masses faster and with systems allowing us a higher return on investment.

Additional benefits include:

Writing the narrative and outline of our company.

Asking and responding to questions that would otherwise go unanswered.

Think about the legal and financial considerations.

With prospective investors, partners, and even clients, be sure to clearly express the possibilities of our company.

Numerous resources are available to assist aspiring entrepreneurs in developing the ideal business plan. But if we are a start-up or have been in business for a while, here are the four most critical elements to include in a winning business plan.

The Company

This section, also known as Business Description or Business Strategy, may have subtopics like Location, Product Offering, Product or Service, Records and Insurance, Business Opportunity, Legal Structure, Business Model, Organization and Operations, Operating Procedures, Management, Personnel, Strengths and Weaknesses, Core Competencies and Challenges, Business Accomplishments, and Operations Description.

Be sure to "sell" the one reason why our business will be able to produce a large amount of cash flow in the Business section. Keep in mind that our sales are based on conveying our knowledge and experience, not on using meaningless phrases and promises to promote our business.

The Marketing

It also goes by the name Market Strategy and has sections covering topics like Target Markets, Customers, Competition, Distribution, Relationships, Advertising, Pricing, Industry and Market Trends, Strategy, and Market Strategy. The industry and our company's position within it are covered extensively in the Marketing section. It encompasses every force that impacts our company.

This chapter provides the reader a comprehensive overview of how our business will handle bringing the product to possible consumers, covering everything from pricing to advertising, industry trends to the global economy, and clients to rivals.

The Finances

The Deal, also known as Financial Data, comprises sections such as Assumptions, Budget and Break-Even Analysis, Capital Spending Plan, Income Forecast, Sales Revenue Forecast, Income Projection, Profit and Loss Forecast, Cash Flow Forecast, Balance Sheet, Income Statements, and Uses of Funds. The numbers are the focus of the Financial chapter. The past, now, and future are all represented.

The Supporting Materials

The kind of business we are considering and the rest of our plan's contents will determine what material we use. Resume, credit reports, letters of recommendation, legal documents, contracts, and agreements are typical supporting materials. This is material that is either covered in the prior sections of the plan or doesn't need any textual introduction or explanation.

Ideally, by the time the plan is finished, we will have all the knowledge necessary to meet everyone's requirements. The actual labor involves gathering the preliminary data. It shouldn't be too hard to arrange it in other ways. Whatever plan we select, make sure we have everything covered. When creating the plan only for the purpose of obtaining a loan, it might be enticing to leave out the management details, or to leave out the financial details if we are making the plan just for our own management needs.

Develop a sound business strategy

Entrepreneurs who are willing to put off immediate gratification are more likely to have successful business plans. They invest the time and energy needed to get the appropriate training and experience, and they take chances. Since errors and failure are experience, they are not scared of making them.

They acknowledge that experience leads to increased competence, therefore they start out little and grow. Paying the cost gives real entrepreneurs the knowledge they need to create a successful strategy and business.

Financial education is the cornerstone of true wealth and the ability to print money like the wealth do. Are we ready to master the ability to raise capital and become an inside investor? A true capitalist. Those who have the wealthy context will succeed in the economy that works with debt and inflation. The more the government prints money, the higher the inflation will have which means the poor and middle class will loose because their money looses value.

The business owner and inside investor will thrive in such economy because we are working with the new rules of money. Start investing in financial education and applying a business plan into action. Take control over our finances and multiply money in sound investing. In order to build true wealth master sales through a system of systems (businesses) and real estate using debt.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Subscribe to our Youtube.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: What Is Modern Financial Education?

Masterinvestor's mission is to be the authentic global brand for money, business, and investing, elevating the financial well-being of humanity through high-quality financial education made simple, with lucrative opportunities to build passive income, win-win partnerships, and true wealth.

Comment, like, share and follow for more High Quality Financial Education Made Simple.