How To Protect Our Wealth?

Discover the steps to achieved limited liability in our investments.

Summary:

An entity that protects our personal assets from business risk is a good one.

Choose the appropriate entity type for our company from the four available.

If we don't follow these proper procedures, we may be held personally liable for any claims made against our company.

Bonus: At the end of today’s article we will find out what is a limited liability company means for our wealth.

When launching a company, a lot of things may go wrong, including the way our entity is set up. We must always seek the proper advice from the real mentors. If we listen to the wrong people then we will not be able to accomplish our goals.

The potential might be fatal, as we will discover from masterinvestor’s financial education here.

As an illustration, a plumber in the Nevada state. He had been working at it for five years, during which time he experienced some genuine success. He was a really talented plumber, but he wasn't very good at legal things like starting his own business. He relied on his part-time bookkeeper for advice while starting his business rather than seeking expert advice.

The bookkeeper for the plumber recommended that he operate as a sole proprietorship because he had no idea how to file papers or create a corporation.

As we can undoubtedly imagine by now, this plumber client's experience wasn't great. After an altercation at the client's home between an employee and a customer, his company was sued. And because he was a lone proprietor, he was sued and had to defend himself rather than the company, unlike in a corporation. The victim was given $10 million by the jury when this case went to trial.

The plumber was completely destroyed. He lost his family, his home, and his savings. In this instance, this terrible incident would have been avoided if he had established a limited liability company.

A limited liability company: what is it?

First, what is meant by the term "entity"? It alludes to a company that is legally distinct from its constituents. It is a distinct entity that exists independently of its owners.

An entity that protects our personal assets from business risk is a good one. A negative entity is one that offers us absolutely no protection. Read our other article post, on How To Choose the Best Entity for Our Personal Strategy? It covers the pros, cons, and ugly of entity setup, to see which ones offer limited liability.

Four categories of entities exist:

C Corporation: A separate legal entity with the ability to make agreements. This organization needs bylaws and articles of incorporation that are submitted to the secretary of state.

S Corporation: A business that has chosen to have its taxes paid to individual shareholders through flow-through status. Additionally, this organization needs bylaws, form 2553 filed with the IRS, and articles of incorporation filed with the secretary of state.

Limited Liability Corporation: This type of organization can be regarded as either a conventional corporation or a S corporation, which is a flow-through tax entity. An operational agreement is advised but not necessary for this organization, which needs articles of incorporation submitted to the secretary of state (such as the one above).

Limited Partnership: This type of partnership has flow-through taxes and limited liabilities. This organization has to file an LP-1 with the state, and while it is not necessary, a partnership agreement is advised.

Note: There is no one-size-fits-all solution for choosing our entity type. To determine which entity best suits our business plan, consult an accountant or attorney.

How limited liability is accomplished?

It's crucial to adhere to these seven measures in order to attain limited liability. If we don't follow these seven procedures, we may be held personally liable for any claims made against our company.

Create a limited liability company: There are several options for entities, and each has unique characteristics and restrictions. Our personal assets as well as all of the business's assets could be at risk if our company is not run as a limited liability company.

Employ a trustworthy resident agent: The individual who receives process on behalf of our entity is known as a resident agent. Following this crucial business protocol doesn't cost much.

Complete the necessary yearly filings: In order to obtain limited liability, we must file annual reports and pay an annual fee to our state. Filing our annual returns is essential to maintaining limited liability, just as creating our corporation and hiring a trustworthy resident agent are essential to starting our firm.

Get ready or consult an advisor to create meeting minutes: Creating meeting minutes shows that we are treating our entity as separate from ourselves. They serve as a written record of the decision made by our entity. We may easily get someone to do this for us.

Put the world on notice: Declaring that we are operating as a limited liability company is an additional way to set ourselves apart from our company . In order to let people realize they are dealing with an organization and not us directly, we should include Inc., LLC, or LP on our business cards, brochures, contracts, and checks.

Keep a separate bank account: Setting aside our personal assets from the entity's assets and keeping separate bank accounts is another way to let people know that we are operating as a limited liability company.

Get separate tax returns prepared by an advisor: Limited liability companies must file separate entity tax filings since they are distinct tax entities. It is not a good idea to include income or expenses on our personal tax return that should be on the entity's tax return. To prevent issues, we want to think about working with a qualified accountant.

By taking these crucial (yet doable) actions, we can safeguard our personal assets and prevent the business veil from being lifted.

Get our eBooks and stay tune for the next reales of new volumes: How To Raise Capital To Build Wealth?, and How To Start Our Own Corporation?

Now we know why the wealthy, we own our own companies and everyone else works for our companies, to find out more about protecting for our company from lawsuits.

Ways to Earn Money Online:

Twelve business platforms that novices can use to generate income online.

Beginners can use business methods to generate income online.

This is a brief guide for novices on how to earn money online.

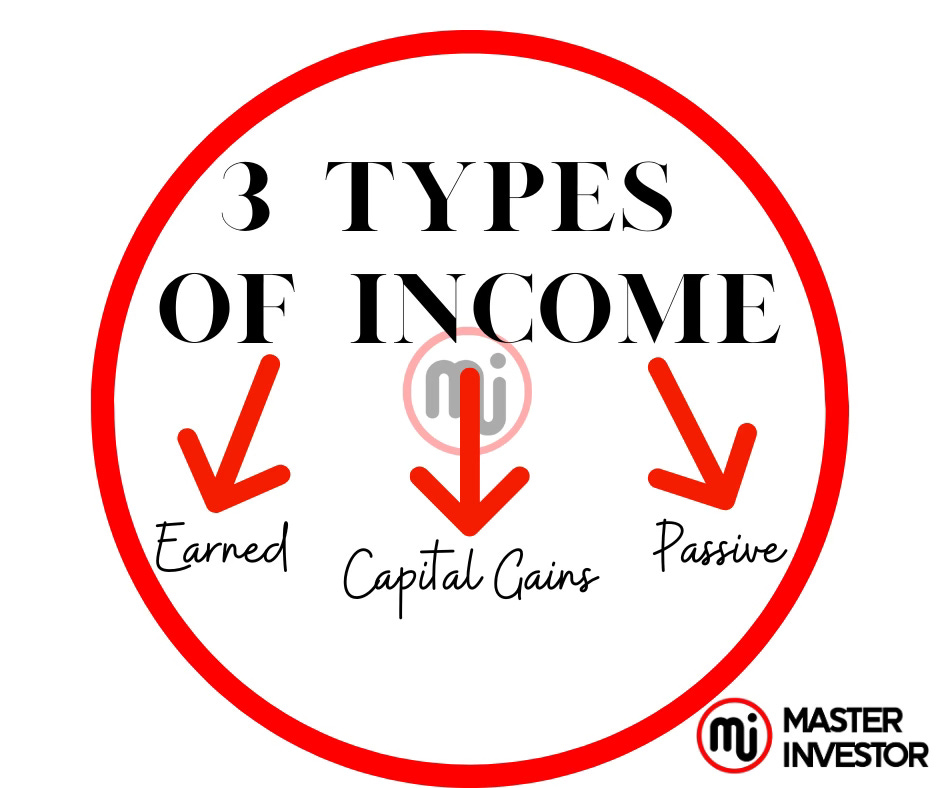

Learn about the three types of income before we start our online income path.

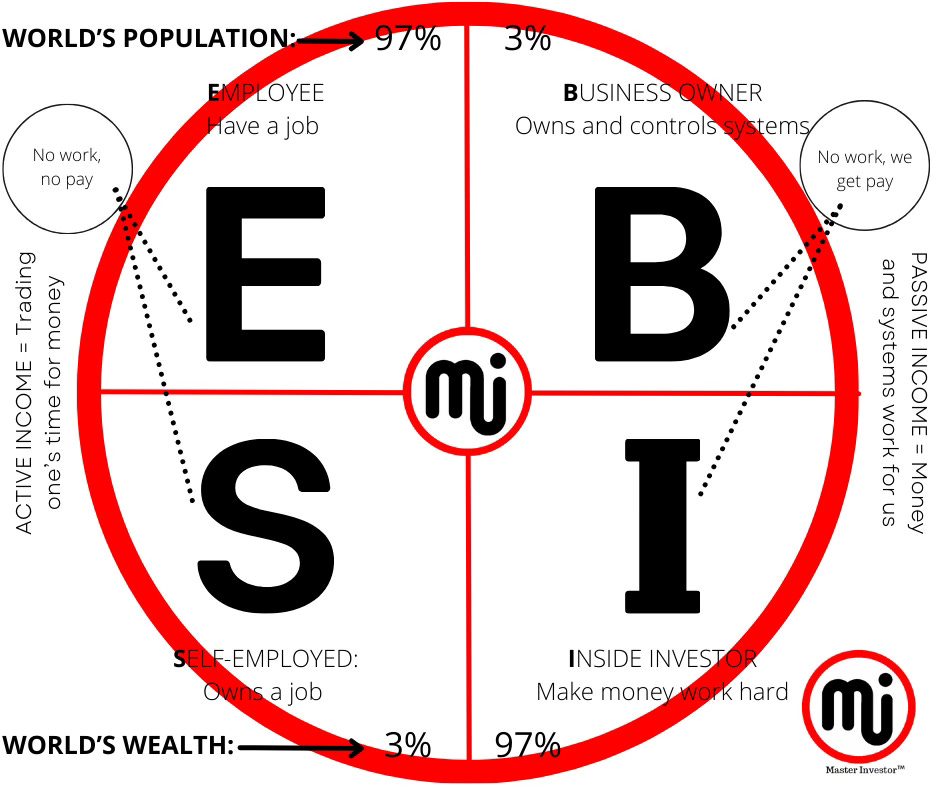

For what reason are we waiting? We have the ability to become entrepreneurs thanks to computers and the internet faster thane ever before. The biggest wealth shift in history is happening as we speak. The question is, are we aboard the new trends and actively investing to be part of the small % of the world who is positioned properly to be the ones who are acquiring true wealth.

In the past, only a select few had the ability to grow into companies that were based on systems and represented the Cashflow Circle’s Business Owner and Inside Investor side. It was very difficult to get in. It was costly and dangerous. Many attempted since, of course, the rewards for success were large. Regretfully, a lot of them failed.

The world is changing today because of the internet. If they know how, almost anyone can create an internet systems-based firm.

We can find several business-building ideas in this article.

Let's start by talking about the reasons why starting a business in the right side of the cash flow circle where being a Business Owner and Inside Investor is so effective.

The ideal form of income is passive income to become financially free and truly wealthy.

In general, there are three different types of income, and they are not all made equal.

Employees' and self-employed people’s earnings are referred to as earned income or ordinary income or active income. This income is taxed at the highest bracket. This frequently entails trading their time for money. With little provisions for tax incentives as an employee and self-employed, it is the income that is subject to the highest taxes.

Income from the investment and sell of that investment, the gains are referred to as capital gains income. People that make money from their capital gains investments often say things like, "Buy low and sell high." If we can make it happen, that's good advice. It also has a high tax rate and needs to be actively managed. Because we frequently have little control over whether something's worth increases or decreases, it can also be risky.

Investors and business owners (those on the right side of the CASHFLOW Circle) earn passive income. It is the most effective source of income. Why? because it has numerous tax benefits, is the income that is least taxed, and puts money in our pocket even while we are not working. We must become an expert at passive income if we want to be wealthy.

Fortunately, there are plenty of online passive income opportunities.

The effectiveness of an online business system

As we said we have the ability today to become wealthy entrepreneurs and inside investors fast thanks to computers and the internet. Our company's systems are operated by the computer. It enables us to use social media and email for online marketing and communication. It provides us with access to legal counsel and accountancy tools. We can use the computer to look for manufacturers anywhere in the world. Additionally, we may simply watch a YouTube video or Google anything to learn more. Education has almost no cost, and the opportunities are limitless. Today using AI in any organization is a must to be able to stay ahead of the competition. AI has open up new opportunities for those who are open to receive the benefits of newest technology.

Building a profitable internet business that generates cash-flow while we sleep is now simpler than ever.

However, the majority of individuals don't use this. Why?

The most effective tool for internet entrepreneurs

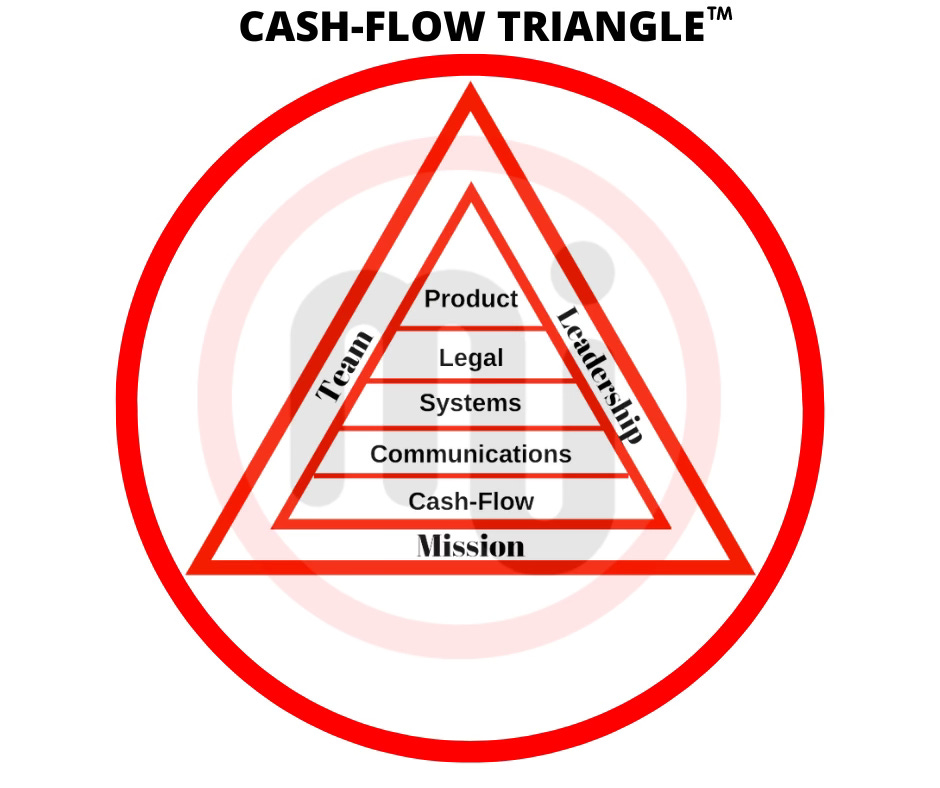

Despite being an effective tool, the computer is not the brains of the digital entrepreneur. Only the system is to blame. To create a self-sustaining system, the entrepreneur must continue exercise leadership even though they are the brains behind it.

A lot of digital entrepreneurs fail because they don't comprehend this. They lack intelligence, but they have the technology. They frequently create Self-employed businesses instead of Business Owners’ ones. Instead of starting a business, they create a job that they own. They and their time are necessary for it to exist. They are not earning money if they are not working, which frequently involves working through the night.

However, a truly digital company can generate revenue without the founder and owner working.

No matter what, the business system keeps running.

Why the secret to success is in our system?

A system of systems makes up the human body. A business is the same. The respiratory, digestive, circulatory, and other systems comprise the human body. The body is likely to be handicapped or perish if one of the systems fails. A business is no different.

Any entrepreneur who wants to develop a successful company should know about the Triangle. All of the Triangle's elements can be expedited at a significantly reduced cost in the internet era.

Methods for Earning Money Online

These are only a handful of the various kinds of online businesses we can start. Although it is not an exhaustive list, it is a starting point. Do we see something we like? Do our homework and go in depth. There are a ton of materials available online for each of these.

Investing time to fine a real estate to practice wholesaling without our money.

The practice of discovering a bargain, getting it under contract, and then finding another buyer who wants the deal—for a fee—is known as real estate wholesaling. In essence, the contract is being sold.

Locate our first investment property in real estate.

Today it does not have to take a long time to launch our real estate company. To obtain hot leads on excellent real estate, we had to attend auctions and investing into the right networking events or engage with a realtor to look over a lot of listings until we find the right one for our plan and strategy.

Investing into paper assets.

The days of need a broker to purchase and sell stocks are long gone. If we prefer paper assets, you can quickly and simply create an online account on websites such as E-Trade, TD Ameritrade, and others.

Investing money into cryptocurrencies.

If stocks aren't your thing, we might want to think about investing in something more unusual, like cryptocurrencies. In this rapidly changing industry, cryptocurrencies like BitCoin, Ethereum, and hundreds more provide a fresh and fascinating method to earn money online. Today is crypto is the new money in the world. It is a full currency like it is the U.S dollars. Investing in crypto with a winning plan is key to building true wealth in our lives.

Sell tangible goods through e-commerce website.

Sell tangible goods through your own business, Amazon, or eBay. Although we may believe that Amazon is only for large sellers, millions of small businesses really sell goods on the site. Actually, it's one of the largest internet marketplaces for small enterprises to sell their goods. We don’t have to be create the products, we can use other pole products and bring in the qualified leads to buy the products. We can also do white label products and all we must do is create the brand of the product.

Build a profitable content business.

Content is king, and it has the power to create an empire if done correctly. There are numerous methods to get here. Think about providing content creation services to others. Obtain a sizable clientele and employ subcontractors to complete the work. Sites like Craigslist, Upwork, LinkedIn, and others are good places to accomplish that. Simply fill our subcontractor bench with work once it is full.

Affiliate advertising.

Publishing on affiliate networks or starting our own affiliate blog are two more excellent ways to earn money online. Affiliate marketing is something we should absolutely look into if we have never heard of it. People are always looking for information and a solution online. When we can present them with articles that gives them information they are looking for and give them an option to buy the solution can be very lucrative for us.

Create a company that does consulting online.

Do we possess sales and technical expertise in platforms like Google Ads, Facebook Advertising, or LinkedIn, or are you familiar with the nuances of search engines? Perhaps our best option for making money online is to work as a small business consultant. We can also hire a team for the ads and other task requires to succeed here.

Create a virtual coach company with systems.

A coach can be a very lucrative online income stream, much like a consultant who offers advice on strategy and business solution execution. Doing online through a platform where others can buy the digital courses and order other products from their online coach. Create a brand with products that reflect our interest and passions.

Own a virtual assistant company.

Do we believe that the majority of online jobs are a bit too demanding? Don't worry; advertise your own company as a virtual assistant (VA) and help clients with basic daily duties. Hire others to do the service to the clients.

Domain flips.

If we are creative and can think of short, catchy domain names, people will pay us a lot of money to own them. And we can let them pay through a monthly payment which creates monthly cash-flow for us.

Become an Internet researcher.

The enormous quantity of knowledge we acquire, let's say as a "side effect," is one of the best things about spending time online. We organize it and sell world wide because people pay for information that is backed by researched and references.

Bonus: What is a Limited Liability Company?

Mastering the use of an LLC and how it works the best for our wealth.

We will explain the significance of cautious investment protection.

An LLC has purposes beyond only safeguarding our company.

Know what an LLC is and how it operates before forming one.

As we expand our network, we will discover that the secret to accumulating wealth is investing, both in real estate and in businesses but not limited to these asset’s classes. We must use a Limited Liability Company (LLC) in the state that provides the best asset protection as our assets increase.

Some believe it would be too costly to invest in this organization. We are individually liable for all claims, nevertheless, if we launch our company as a sole proprietor.

For instance, if a plumber is called in to a job and anything goes wrong at someone's house, the homeowner may sue us for all of our personal assets, including our bank account balance and home equity, in addition to the plumbing business assets.

Establishing a solid entity from the outset is crucial, regardless of whether it is a single-member or multi-member organization. Denying protection to a single-member LLC is a nationwide trend. We must learn how to safeguard that kind of organization below.

Nevertheless, even if we owns a one-member LLC, places like Nevada, Wyoming, and Delaware will still protect him.

Establishing an LLC, we must use strategy and be tactful

However, when establishing up in certain states, always exercise caution. California, for instance, is the worst in this area. California declares: "Mo is hurt. Regardless of whether Mary is there, blow through the LLC. They will make it possible for Mo to seize Joe's assets and compel the LLC interest to be sold.

Our goal is to set things up so that the LLC and charging order protection are utilized.

Let's say we own an Oregon property. Its title will be transferred to the Oregon LLC that is held by a Wyoming LLC. After that, we purchase real estate in North Carolina. The Wyoming LLC also owns our North Carolina LLC.

An inside attack occurs when a renter files a lawsuit against the property. They are able to obtain the contents of the Oregon LLC. Let say a person is not the owner of the Wyoming LLC; rather, he or she has a claim against the LLC itself.

The property in North Carolina is out of their grasp. Wyoming, which owns all the others, is off limits to them. Our assets are protected. What is the reason for not wanting to include ten properties in this one LLC? It turns into a target.

Of course, we have partners who only do one property per LLC. Some will perform two or three. We don't want them to be able to receive a lot of money from ten or more properties, however it will depend on how much equity we have in each one.

Since the Wyoming LLC will own all of our other out-of-state LLCs, we should take advantage of its strategic posture.

It's crucial to remember that states like North Carolina and Oregon might not provide protection for single-member LLCs. For that security, we truly need this Wyoming entity here because it one of the best states for LLC’s protection.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Subscribe to our Youtube.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: How To Protect Our Wealth?

Masterinvestor’s mission is to be the global authentic brand of money, business, and investing that elevates the financial well-being of humanity through high-quality financial education made simple with lucrative opportunities to build passive income, win-win partnerships, and true wealth.

Comment, like, share and follow for more High Quality Financial Education Made Simple.