How To Navigate Crypto Cycles?

Understanding Market Cycles in the Crypto World

SUMMARY:

We can make wiser investment decisions if we comprehend the cycles of the cryptocurrency market.

Understanding market trends enhances profits and lowers the chance of panic selling.

Knowing the phases of a cycle offers us the ability to determine when to purchase and sell.

Bonus: At the end of today’s article we will cover the reasons Solana ($SOL) should be in our portfolio for a cryptocurrency investment to multiply our money.

By applying cycle insights, we may increase our resilience and make money in both profitable and unsuccessful markets.

It might be stressful to try to make sense of a market that is full of ups and downs. This is particularly true for cryptocurrency. We will discover that cryptocurrency requires a different strategy than equities if we are accustomed to conventional markets.

This post will teach us how to stay afloat and position ourselves for success during the cryptocurrency market's highs and lows.

Let's get started!

Why Are Market Cycles Important in Cryptocurrency?

Despite its seemingly complex nature, the cryptocurrency market may be deconstructed quite easily.

It goes through several distinct stages, which are impacted by things like media coverage, investor sentiment, and changes in the economy.

Don't worry if we don't understand; I'll explain it to us.

The phases are as follows:

Prices level out during accumulation, and long-term investors begin purchasing.

Demand drives higher prices when an uptrend begins, and marketing and media spend rises as well.

Digital assets reach their peak during the distribution phase, early investors collect their winnings, and volume levels out before a possible reversal.

The last stage is a downtrend, which results in declining prices as sellers gain the upper hand and accumulation resumes.

This pattern has often occurred with Bitcoin (BTC).

Additionally, these cycles are subject to swift changes, typically as a result of regulations or investments from well-known companies like MicroStrategy and Tesla.

Because they can be impacted by things like global economic trends and regulatory crackdowns, these periods are far more volatile than in regular markets.

Recognizing a Crypto Market Cycle's Four Stages

After discussing the four phases, it's time to delve deeper into the specifics.

When prices and interest rates are low, seasoned investors purchase in bulk. At this stage, sentiment is typically neutral or negative (recall the periods when people were negative about bitcoin before its price increased).

As demand rises and excitement builds, more investors join the rally. This stage can be identified by a noticeable rise in trade volume and a consistent price increase.

At this point, the line is continuously rising and heading to the right on the token's chart.

Because they know the peak is coming, smart money investors begin to sell during distribution. As experienced sellers cash in on fresh purchasers, prices become unstable.

Finally, a downtrend can cause a significant decline in prices since it triggers a wave of selling.

Because buyers who joined late or missed the opportunity to profit frequently begin to worry, this period is the riskiest.

This is the point at which panic sets in and the loudness rises. Although it's sometimes the most difficult time for novice investors, when prices finally bottom out, it also marks the next chance for accumulation.

How to Succeed in a Bear Market (Downtrend)

It might be quite difficult to resist the urge to sell our cryptocurrency when the market starts to decline, but it's best to have a long-term perspective.

The following tactics may be useful:

To diversify our risk and take advantage of those great lower prices, start by dollar-cost averaging: invest a certain amount at regular periods.

Pay attention to items we trust. Research projects and strengthen our positions during bear markets.

Remind ourselves that downturns are a natural part of the cycle if we start to feel pressured to sell. Selling in a panic only results in losses. Here, maintaining composure makes all the difference.

Getting the Most Out of Uptrending Bull Markets

When the market is on an upward trend, what should one do?

For individuals who already own cryptocurrency, this stage can be thrilling and lucrative, but for those who wish to enter, it can be dangerous.

It's simple to get swept up in the excitement and desire to follow the sentiments as the cryptocurrency market begins to rise.

Steer clear of FOMO (fear of missing out), as investing too much at this stage may leave us overextended if prices drop unexpectedly.

To safeguard our gains, set reasonable profit goals and take some profits as prices increase. Now is the moment to create a diverse portfolio rather than putting all of our money into one asset.

A crypto profit calculator is an excellent tool for calculating profits.

Here are a few:

The Crypto Profit Calculator by CoinStats

The Free Crypto Profit Calculator on Coin Ledger

Whatever you choose to do, keep in mind that the upward trend won't continue indefinitely. We hope that knowing that brings some consolation.

To control our risk when trading, monitor our assets and employ stop-losses.

We have the opportunity to maximize our portfolio during this era, but avoid being overly ambitious.

Utilizing Resources and Tools to Monitor Market Cycles

We can use a number of methods to determine the potential direction of the market.

Tools for measuring market mood include indicators like the Fear & Greed Index.

Additionally, on-chain data from sites like as Glassnode indicates changes in the behavior of major holders.

Platforms like LunarCrush, which follow social media chatter around cryptocurrency, offer sentiment research if we are truly want to see things from a wider angle.

CoinMarketCap and CoinGecko provide simple, easy-to-use tools for novices.

In-depth analytics on sites like TradingView may be preferred by more experienced investors.

These are the greatest tools available, and they are largely free to use. These tools provide our trading strategy a data-driven approach and assist us in sifting through the deluge of cryptocurrency news and social media.

Emotional Techniques for Maintaining Composure in the Face of Market Volatility

We're about to take a ride, so hold on to our feelings. A masterinvestor is always in control over our emotions.

It may be a very potent indicator if we use investing to identify when people are feeling that way rather than letting ourselves feel that way.

Four indicators of FOMO or panic selling in cryptocurrency are as follows:

Having a sense of exclusion

Classic FOMO occurs when the price of a cryptocurrency token is rising and you feel compelled to purchase it because "everyone else" is profiting. This feeling of missing out might cause people to make poor or rash judgments without taking the coin's true value into account.

Impulsive Purchases

FOMO is demonstrated by making rash, unresearched purchases solely because an asset is trendy. This tendency typically occurs when excitement over a particular cryptocurrency grows, frequently as a result of news or social media.

Regularly Verifying Prices

We may be responding to panic if we find yourself constantly checking prices or news updates, particularly when values are declining. Continuous observation causes tension and may lead us to make irrational sales decisions.

Fear-Based Selling

Panic selling is when we feel pressured to sell right away because prices are dropping. Without a defined exit strategy, this reaction frequently stems from a fear of further losses.

We can control these feelings.

To prevent emotional reactions, set definite financial goals and think about automating our buys and sells.

Reducing the frequency of your price or news checks might also be beneficial, particularly when the market is declining.

Sometimes the wisest course of action is to take a step back.

Investing is having a winning plan. We must have a a plan with a lucrative exit strategy that assure us that we will get our invested capital back sooner than later and the amount that will continue to collect after we have recoup our initial investment back.

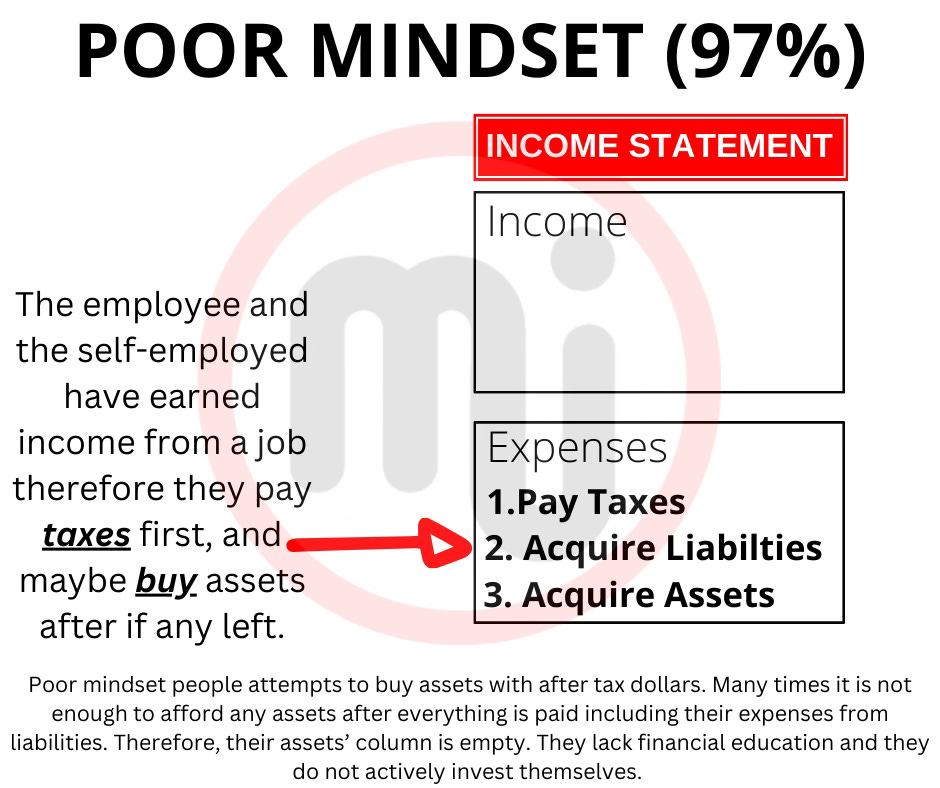

Why the poor are poor?

Simply because of their priorities with money. They focus on the income that comes from a job, earned income. That is taxed at the highness bracket and there are no benefits to minimize taxes by operating on the left side of the cash flow circle as an employee and self-employed. They focus on pay taxes first and investing last. As they run out of time and money by the end of their priorities list, then they have no solid path to financial freedom and true wealth.

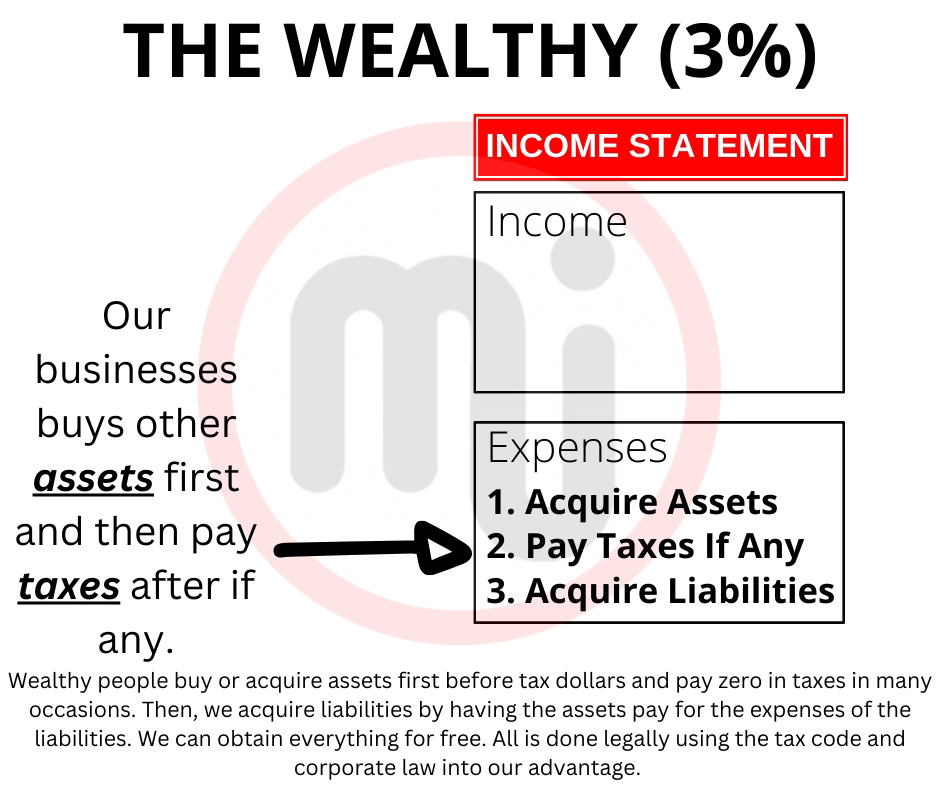

Why the wealthy are wealthy?

We choose the wealthy context and put our investments as priorities in our expenses column. So any money we ever have will have to go into a sound investment first before anything else. The following diagram shows how we invest to become part of the small percentage that thrives in the game of money of the world.

Concluding remarks

I hope this post has given you a better understanding of the many stages of cryptocurrency and helped us figure out how to utilize them to choose when to stock up and when to sell.

Remember that every stage has its own set of chances and difficulties, and the more we comprehend these cycles, the more equipped we will be to make wiser decisions.

Make investing in our future a component of our financial objectives and have faith in yourself.

Read our e-books if we are prepared to explore other tactics.

Bonus: Why We Should Consider Solana ($SOL) Cryptocurrency As A Sound Investment For Our Portfolio?

Find out why Solana might be a better option in a volatile cryptocurrency market.

Learn why Ethereum, Bitcoin, and Solana are safer options than other altcoins.

Considering Solana as a digital asset rather than a gimmick to make quick money.

When it comes to cryptocurrency, there are typically (but not always) two sides:

Enthusiastic cryptocurrency advocates

Crypto detractors who are vocal

Despite the existence of these opposing viewpoints, we have found that many individuals who are considering include cryptocurrency in our financial portfolio do not fully comprehend how it operates. Remember that before we invest, we first learn about and put a winning plan together for the investment.

This got us thinking about how to empower and educate hesitant cryptocurrency investors, which is how we looked at Solana as a possible remedy.

Lottery Tickets vs. Digital Property

It might be very tempting for someone who is passionate about cryptocurrency to follow the buzz around tokens on social media and believe they are the way to make quick money. However, this type of thinking is similar to gambling. which is taking big chances in the hopes of getting big benefits.

Treating cryptocurrency assets more like digital property than lottery tickets would be a preferable strategy. We can position yourself for more security and growth just by adopting this new perspective on your assets. Stress and FOMO (fear of missing out) may be lessened by it.

What is Solana?

A blockchain network called Solana was created to facilitate transactions more quickly and affordably than Ethereum. Since its 2020 launch, Solana has gained a lot of popularity due to its ability to process multiple transactions per second more quickly and easily than many other networks. The primary factor contributing to Solana's increased popularity among developers for Decentralized Finance (DeFi) projects is its speed.

Why Solana?

Solana ($SOL) provides an alluring balance between risks and returns for anxious cryptocurrency investors who are unsure which well-known tokens have a decent chance of surviving market turbulence.

Remember that Solana is not like Bitcoin; its price chart cannot display that level of strength. Nevertheless, investors who have carefully controlled their risk have found value in Solana throughout its downturns.

The following price points from recent years should be noted:

2021: Solana experienced a surge in growth, peaking in November at about $259.44. For Solana, 2021 was a fantastic year.

2022: The market slump had an impact on a number of cryptocurrencies, including Solana, whose price peaked early in the year at about $179.34 before falling to a low of about $8.03 by the end of the year.

2023: Solana had a little uptick in price, peaking at $123.35, after dropping to about $9.96 in the early months of the year.

2024: Solana saw additional encouraging growth in 2024, peaking at about $209.59 by the middle of the year.

When Solana Is Most Effective

The possibility that their investments could lose all of their value during market downturns is one of the main worries of novice investors. This is an understandable fear, which is why risk management techniques like:

Don't risk money you can't afford to lose.

Dollar-cost averaging modest, risk-controlled sums.

Establishing Stop-Loss Put in place a system that will sell cryptocurrencies automatically if their value falls to a specific level.

The wisest course of action in the Solana circumstance would have been to invest in it when it was at its lowest, not its greatest, price.

The ideal moment to invest in a blue-chip token (such as Ethereum, Solana, etc.) is when it has:

A track record of price increases

Reached the bottom of it

Many developers are working on blockchain applications.

Applications in the real world

Cryptocurrencies like Bitcoin, Ethereum, and Solana have outperformed other altcoins in terms of resilience since 2020. They are unique because they have practical uses and are supported by extraordinarily robust communities, making them more than just speculative assets. This can make these tokens a safe refuge for altcoin conversions when the market seems to be moving in a direction that incites dread.

The Greatest Advice for Solana

There are certain useful skills that people who may already have Solana can take to make the most of this network.

Think about staking on Solana: If we stake our coins on a proof-of-stake network, Solana provides token holders with a special chance to generate passive revenue. Rewards for Solana staking are distributed every two or three days. We will regularly receive rewards for our SOL stake as a staker, and we might choose to compound them by restaking. The total SOL stakes and network conditions may affect the rewards. The APY reward rate might fluctuate over time and varies from 6 to 7% APY.

Examine Market Sentiment: If we choose to become associated with Solana, stay informed about its pricing and general atmosphere. Before making an investment, track market sentiment on forums, whale wallets, and social media to predict future market movements.

Remaining Liquid: To make it simpler to purchase or sell assets during market ups and downs, it may be wise to allocate a portion of our portfolio to stablecoins like USDC or USDT rather than cash.

Avoid FOMO: Instead of following trends, adhere to your financial plan and ignore your FOMO.

How to Find Out More About Solana

Making sure you fully investigate tokens and networks before getting associated with them is a crucial stage in the cryptocurrency process. You may get more information about Solana on these websites.

a target="_blank"> a href="https://www.coingecko.com/en/coins/solana"CoinGecko: For the history and price chart of Solana.

Solana 101 Page: The official website and information page for Solana is called 101 Page.

Solana News: This is the official website and blog page for Solana.

Our crypto courses, which provide education and awareness along with a weekly crypto newsletter, are another way to learn more about blockchains like Solana and cryptocurrency in general.

Being informed is the best course of action when it comes to cryptocurrency. Even with the several strategies discussed in this article, it can be challenging to reduce our risk factor when it comes to cryptocurrency. Creating a diversified portfolio is the key to surviving the turbulence of a crypto-winter market. Investing in tokens during these downturns may yield rewards when they rebound, but bear in mind that this is only a possibility and not a certainty. Conduct thorough independent research and get appropriate guidance from a financial advisor.

While having a strong interest in cryptocurrency is admirable, learning more about it is even better.

Are we looking to invest in any cryptocurrency? Read our eBooks and get our digital courses with its tools and total guide that offers helpful advice to get us started in or inviting and entrepreneurial journey.

(Disclaimer: This article is not financial advice and is intended for educational purposes only. Our articles are not sponsored or affiliated with any of the businesses, tokens, teams, or protocols mentioned. It is important to conduct thorough research and only invest an amount that you are comfortable potentially losing. For financial advice seek an advisor and conduct our own due diligence.)

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Subscribe to our Youtube.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: How To Navigate Crypto Cycles?

Masterinvestor’s mission is to be the global authentic brand of money, business, and investing that elevates the financial well-being of humanity through high-quality financial education made simple with lucrative opportunities to build passive income, win-win partnerships, and true wealth.

Comment, like, share and follow for more High Quality Financial Education Made Simple.