How To Find A Formula To Be Wealthy?

Look for a formula that works and stick to it until succeeding.

Summary:

There are many proven formulas to creating wealth.

Consistency just like with anything is crucial.

Pick a formula that will take us to financial freedom and beyond.

Lack of financial literacy is costly.

It's time to become financially savvy because the outdated money rules are no longer effective.

We are the only one who can increase our understanding of finances; don't rely on others to do so.

Bonus: At the end of today’s article we will cover the four pillars or foundations of financial literacy.

The idea or product that will make people wealthy excites the majority of new business owners. The problem is that a company's success is shaped before it even exists.

We have to decide the mission, team, leadership, cash-flow, communications, systems, legal and product for a business to succeed.

Here at masterinvestor we define investing as having a wining business plan with a lucrative exit strategy. Investing is only investing when it is done with a plan.

Building wealth can be mechanical, boring and dull. We must be prepare to embark in a journey that many don’t make it due to the courage, strength and leadership to succeed at building true wealth.

A lot of investors drive through the country like a family. Suddenly, a number of big deer with enormous horns arrive on the road front of them. "Look at the big bucks!" exclaims the driver, who is typically the male household member. The bucks automatically run off the road and onto the field that runs alongside it.

The driver starts pursuing the huge dollars across the farm and into the trees after veering the vehicle off the road. It's a rocky and tough ride. The driver is being yelled upon to stop by the family. The vehicle abruptly crosses a stream embankment and plunges into the river below.

The story's lesson is that when we start pursuing the huge money instead of sticking to our straightforward plan, this is what occurs.

Many people struggle in silence and alone when it comes to money. Their parents probably followed suit. As our strategy develops, we will start to get to know the new team members who will help us realize our financial goals.

Our financial team may consist of the following individuals: banker, accountant, lawyer, broker, bookkeeper, insurance agent, board of directors, and successful mentors.

We might wish to regularly schedule lunch meetings with each of these individuals. When we accomplished that, and we learnt the most about investment, business, and how to get really wealthy at these gatherings.

Because team members are similar to business partners in many respects, keep in mind that finding a team member is similar to finding a business partner.

They collaborate with us to take care of our life's most crucial business. We have to mind our own business if we want to be wealthy, whether we work for ourselves or for someone else. The strategy that suits us the most will gradually emerge as we mind our own business. We will therefore have a decent chance of achieving all of our goals in life if we take our time and continue to move forward one step at a time.

Personal Financial Statement

Mastering our personal financial statement could the most important thing we can do to create true wealth and total freedom. People that don’t take their time to figure out their financial statement will not know how to thrive in the world we are living in that operate with debt. Yes, a world where money is no longer real money but a full currency.

That means that we can do and operate just like the government does when it comes to investing. The government literally prints debt daily to invest in our economy. We are over 31 Trillion Dollars in national debt and that is not going to stop. It may slow down but inflation will be part of the new economy. The solution is to pick an investment formula that works today and execute the plan.

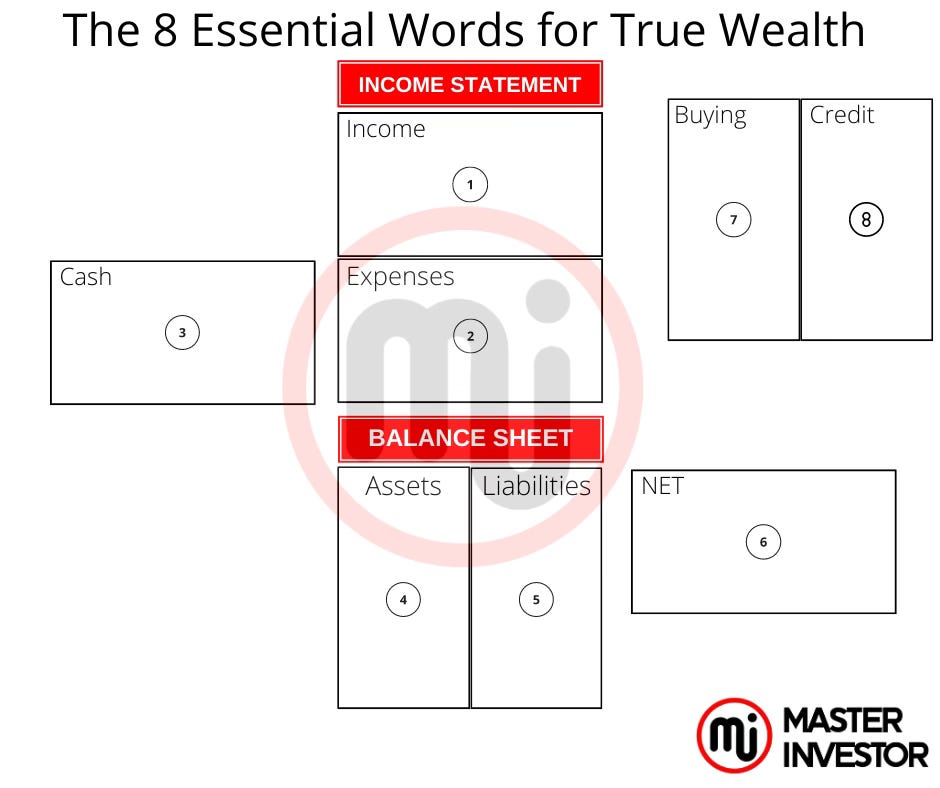

The most important words of financial statements are:

1- Income Column

2- Expenses Column

3- Assets Column

4- Liabilities Column

5- Cash

6- Flow

6- Buying Power

7- Credit

8- Net

Core Financial Priorities

To build wealth we must learn to prioritize the right choices. We have three options for financial core values that we can organize in a list. The following is how must people choose to be:

1. Secure

2. Comfortable, and

3. Wealthy

However, that is the main reason why majority of people in the world never gets to experience financial freedom and true wealth. Because they choose to be safe, comfortable and then they think about becoming wealthy last. When we study the wealthy, we can see a huge difference in the way we prioritize that list of financial core values.

The following is how the wealthy have this list:

1. Wealthy

2. Comfortable, and

3. Secure

When we prioritize becoming wealthy as number one then we will make different decision when it comes to our life and how we approach money. Everything changes just with that small change of our list of priority. The wealthy mindset understands the importance of focusing on the assets’ column and not just in the income’s column.

The poor mindset is always looking to feel secure in life because that is the way they were taught to be to search for security first which is the opposite of freedom. First, we need to focus on freedom and not being secure, by simply acquiring cash flowing assets then once we successfully reach financial freedom then we can have financial security. The goal is to create a winning business plan with a lucrative exit strategy.

Choosing what we want to be when we grow up and then continuing to grow up is the secret to staying young. Choosing to be a wealthy entrepreneur and inside investor could be the best thing we can ever decide to because the rewards of total freedom is exciting for anyone in today’s world that is full of cool things.

There is nothing more heartbreaking than witnessing individuals who have undervalued their own potential. They believe that being economical, saving, and scrimping is a sign of financial intelligence. In actuality, it limits their financial options, and as they age, it becomes evident in their appearance and attitude toward life. The majority of individuals live their entire lives in a state of mental captivity around money. They start to resemble untamed lions imprisoned in tiny zoo cages. They merely walk back and forth, pondering the fate of their former existence.

Knowing what is financially feasible for their lives is one of the most significant insights that people may gain by investing the time necessary to learn how to plan. And that is invaluable.

Additionally, the ongoing planning process keeps us youthful. People frequently ask us why we devote our time to expanding our businesses, making investments, going to business events and increasing our passive income. We do it because it makes us feel wonderful to be able to make tax free wealth and enjoy total freedom. Even though what we do brings in a lot of cash flow, we do it because it keeps us youthful and vibrant. When we can help others lives become better through a product we control and launch to the marketplace is the best feeling ever.

The important takeaway is that we must focus in our purpose in life and find strong enough WHYs behind what we do. Because with the right reasons behind, then we can persevere through the tough times. Being a wealthy entrepreneur and inside investor requires a lot of strength, courage and leadership. All can be develop through devotion of learning about money and using proven formulas to create tru wealth which is tax-free.

We stay younger at heart the more we learn about the potential of this amazing gift called life. Individuals who exclusively make security-related plans or who predict that their income will decline after retirement are making plans for a life with less, not more. Given that our creator designed an infinitely abundant life, why would we intend to restrict oursleves to having less?

We must have a plan to become wealthy by putting becoming wealthy as number one priority in our lives. Then, we look to be comfortable and secure. However, first we focus on becoming wealthy regardless of the obstacles we will encounter along our journey. We have to have courage, strength and leadership.

Ways To Invest In The Economy

The government encourages business owners and inside investors to invest in the economy in order to improve the environment, energy, housing, and jobs.

Being mediocre when it comes to taxes doesn't pay.

We must permanently reduce our taxes if we want to accumulate enormous fortune.

Three strategies exist for making economic investments without becoming excessive taxpayers.

To put it plainly, taxes are unfair to the typical taxpayer. However, who is the typical taxpayer? The typical taxpayer has a family, a job, and either rent or a mortgage. The tax payer does not have financial education and lacks assets that produce passive income. The typical taxpayer knows very little or nothing about finance. H & R Block and the mainstream media are the sources of counsel for the typical taxpayer. The only tax benefits accessible to the typical taxpayer are charitable contributions, property taxes, and personal exemptions and itemized deductions. Of course, they can also delay some of their taxes until retirement by setting up a 401(k) or IRA in the United States or an RRSP in Canada.

Become an above-average taxpayer (sometimes known as a "super taxpayer") rather than an average one. This county and the capitalist system is built to pay zero in taxes legally because it benefits the business owner (wealthy entrepreneur) and inside investor. We start by looking for problems that we wish to solve with a valuable product. Start by increasing our economic contribution, which is what the government pays us for.

Three strategies to invest in the economy and avoid being mediocre are as follows:

Real Estate

One investment that is tax advantageous is real estate. The government of every nation will compensate us for our real estate investment. This is how it operates.

Using debt and taxes are the two main strategies for real estate investing success and true wealth.

Let's say you make the decision to buy investment property in Country X. We discover a $1 million property with $80,000 in net operating income. We borrow as much as we can from the bank instead of paying cash with our own funds.

Consider the following scenario: the bank lends us 80% of the property's cost, and we provide 20% of our own funds as a down payment. The bank gives us an interest-only loan with a 4% interest rate. The property's net cash flow is $48,000 ($80,000 minus 4% x $800,000). The government is prepared to reimburse us for our investment.

For the first few years, the depreciation deduction on a $1 million home should be around $100,000 annually. Consequently, we incur a loss of $52,000 for tax purposes ($48,000 less $100,000 depreciation), even if the cash flow and genuine net profit are $48,000. As long as we are a professional investor, we can use the $52,000 loss to offset other income, such as business or investment income, in addition to not having to pay taxes on our $48,000 in cash flow (tax-free income). A $52,000 loss in the 40% tax bracket translates into $20,800 less taxes on our investment and business income ($52,000 x 40%). We are receiving more than $20,000 from the government to invest in real estate.

Gas and Oil

In an effort to lessen its reliance on foreign oil, the US has long maintained an energy strategy that encourages oil and gas production within its borders. By offering substantial tax breaks to investors in domestic (U.S.-based) oil and gas drilling operations, the government has implemented this through the tax code.

One of the best tax shelters in the United States is oil and gas. Do we recall the book's earlier explanation of passive income and passive losses? The only investment that is exempt from these regulations is oil and gas.

We can write off a significant portion of our investment in the first year when we invest directly in an oil and gas drilling project in the United States. Imagine spending $200,000 on an oil and gas drilling project rather than the real estate venture. Up to 80% of your first investment, or $160,000, can be written off against your other business, pay, or investment income in the first year. The government would pay you $64,000 ($160,000 x 40%) for the investment if we were in a 40% tax bracket. By providing 32% of the project's funding, the government has essentially agreed to be our partner in the drilling effort.

Over the next few years, the remaining 20% can be written off, giving us a $200,000 deduction and a possible $80,000 tax benefit. Furthermore, not all of the money you earn from the project is taxed by the US government. Because of the 15% deduction for depletion, only 85% of the project's income is subject to taxes. Just $850 of your $1,000 in project income is subject to taxes.

Pro tip: The only investment in which we are exempt from the regulations limiting losses from passive investments is oil and gas.

Agricultural

The majority of nations offer substantial tax benefits to individuals who own agricultural enterprises. The explanation is straightforward: the government encourages us to invest in regional agriculture because it wants the economy to expand.

The two most significant tax benefits for agriculture are the ability to trade cattle without paying taxes and the tax deduction for expenses related to agricultural companies.

Agriculture is also favored by the depreciation rules. We could be able to deduct farm equipment more quickly than other types of equipment, depending on the country. Additionally, some of the money you make from our farming operations could not be taxable, or if we make it through a cooperative, it might be taxable later.

Additionally, farms typically receive preferential treatment when it comes to estate taxes. When we inherit a farm, we might be able to pay less in estate taxes or spread out the payments over a number of years. In order to keep farms and ranches operating, the government offers tax exemptions that spare us from having to sell our property in order to pay taxes.

Strong tax benefits for agriculture are particularly available in developing nations. For instance, Puerto Rico offers a 50% tax credit for investments in agricultural enterprises, along with a 100% exemption from property taxes, equipment taxes, municipal taxes, and stamp duties. For a maximum of nine years, Ethiopia completely exempts agricultural enterprises from income taxes.

Incentives are not limited to underdeveloped nations. The expenses of operating a farm are fully deductible in the United States and the majority of other nations. The converse is true in agriculture, where most enterprises must include production costs in inventory and cannot deduct them until the item is sold.

In the year of purchase, the cost of seeds, feed, and other farm or ranch operational expenses that go into producing the food and livestock are deductible. Therefore, we can still deduct the cost of producing the cattle and hay in the year that we spend the money, even if we don't sell them for a number of years. The government has made an investment in our farm.

Bonus: What are the four pillars of wealth?

The fundamentals of financial literacy

Lastly, wealthy parents make sure their families understand the four pillars of financial literacy. When it comes to money, this is by far the most significant lesson that children will learn. If we internalize these principles and spend our life learning more and more about them, we will position ourselves and our team for financial success.

These are the four pillars:

Being aware of the distinction between a liability and an asset;

Capital gains versus positive cash-flow;

Getting wealthy is done by paying zero in taxes legally and managing on good debt, and

Making our own financial choices

It's important to keep in mind that the greatest approach to raise wealthy future generations is to set an example for them.

Start investing in high quality financial education, by reading our financial eBooks:

Lucrative resources and tools:

Follow us on Instagram.

Listen to our Podcast.

Subscribe to our Newsletter.

Subscribe to our Youtube.

Follow us on Tiktok.

Purchase a business digital Course.

Like our Facebook Page.

Join our Inner Circle.

I am reading: How To Find A Formula To Be Wealthy?

Masterinvestor’s mission is to be the global authentic brand of money, business, and investing that elevates the financial well-being of humanity through high-quality financial education made simple with lucrative opportunities to build passive income, win-win partnerships, and true wealth.

Comment, like, share and follow for more High Quality Financial Education Made Simple.